Attorney Fee Deferral Strategies

Custom Tailor YOUR Plan

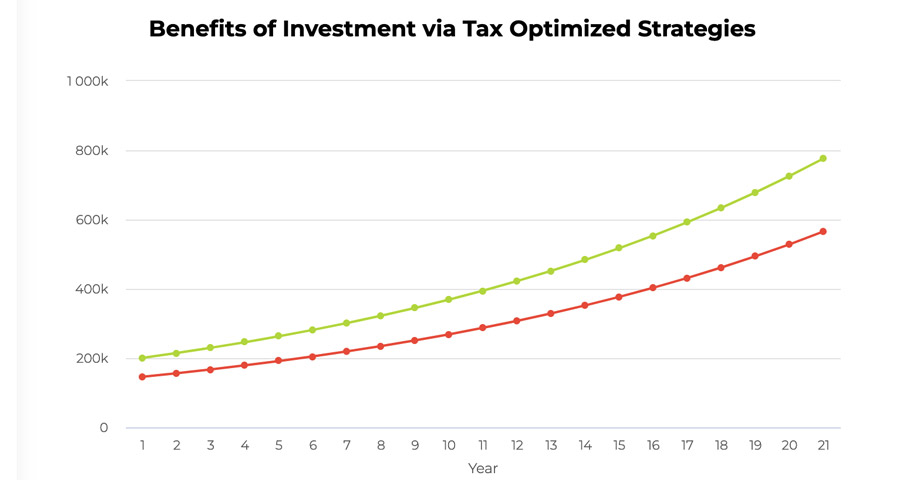

Are you looking to mitigate the impact of taxes on future earnings? Are you looking to invest into your future more intelligently? If you answered “yes” to either of those questions, an attorney fee deferral plan might be the best option for you.

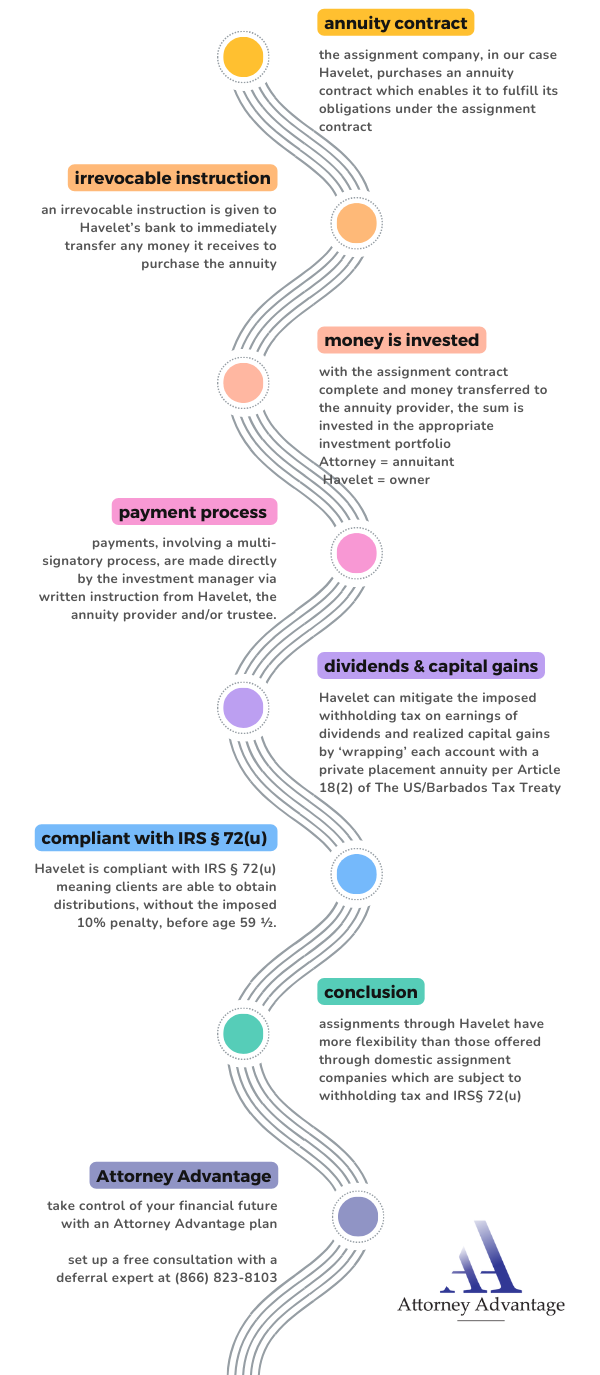

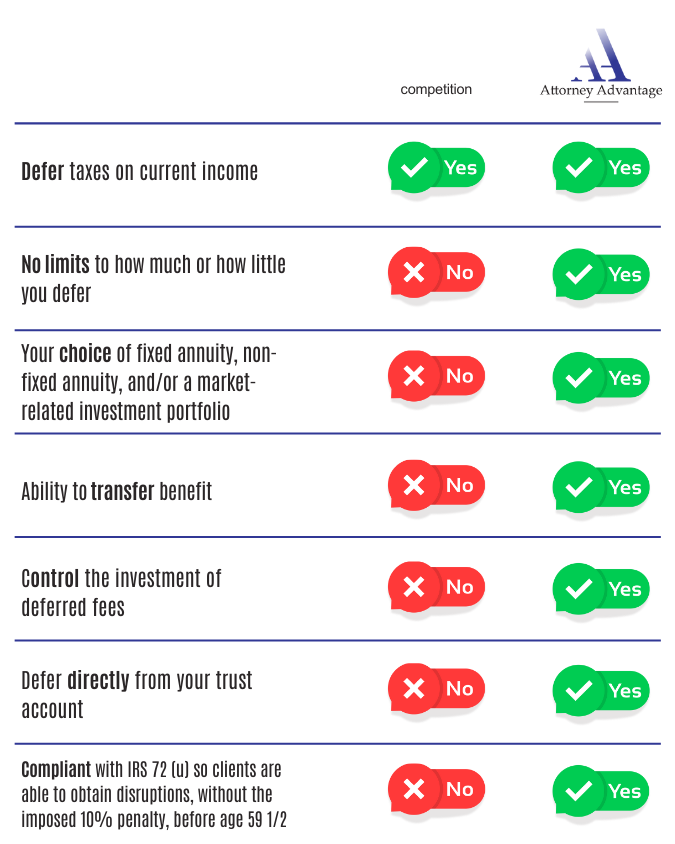

Through a consultative and collaborative process our investments experts will work with your accountant and financial advisor to custom tailor an attorney fee deferral plan that works best for you. Take a look at the three products below and educate yourself about the benefits and drawbacks of each plan.

Fixed Rate Annuities

Fixed annuity with set rates of return and set payout periods. More conservative but virtually no downside risk.

Variable Rate Annuities

Variable annuity with an equity indexed rider based on market performance. More risk but more reward.

Deferred Compensation

Variety of investment options with more payout flexibility. Can push payments if scheduled payout not needed.

Create Customized Payment Streams

Whether you are interested in deferring taxes or investing into your future, attorney fee structures can be utilized to create payment streams to help meet those goals. Consult an Attorney Advance fee deferral specialist today.

Defer Taxes to Future Years

Create a Retirement Fund

Craft Monthly Mortgage Payments

Fund your Children's Education

Guarnatee Future Fixed Firm Costs

Benefits of Attorney Fee Deferrals

- Tax Deferral

- Income Averaging

- Multiple Investment Opportunitie

- Asset Protection

- Retirement Planning

- No Limits in Amount or Age

A Better Process

FREE Attorney Fee Deferral Guide

Want to take the first step to take control of your financial future? Click the button to download are free attorney fee deferral guide.

A Better Company

Educate Yourself through our Resource Center

Memberships & Associations